An Eccentric Guide: What Is an ABA Transit Number?

Aug 08, 2022 By Triston Martin

Introduction

What Is an ABA Transit Number? Using an institution to transfer money from one location to another is possible in various situations. Electronic checks are a convenient and cost-effective way to make payments. A wide range of information is required in this case, including the account number, the routing number, and a variety of other numbers. Here's how the ABA number was devised. To identify the locations where checks were processed, the American Bankers Association (ABA) created "the" ABA routing numbers in 1910. However, its importance has grown as a result of its increased use. Direct deposits, electronic fund transfers, and other transactions can all be made using the ABA number. There are nine digits in the ABA number.

ABA Numbers and Routing Numbers

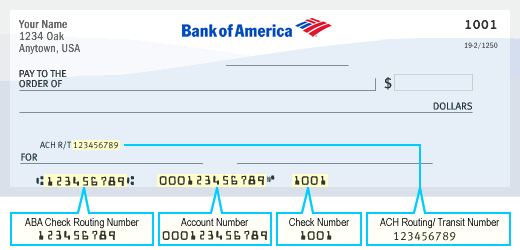

There is a common belief that the ABA numbers on a cheque are identical to the routing numbers, but this is not always the case. Some banks may have different ABA numbers for wire transfer, ACH, and direct deposit transactions. Even though ABA numbers are typically used to route payments, you can also find them on two different forms and even on checks. Please find out how your Bank works by contacting them. Your bank account information, routing number (also known as your account number), and your check's unique check number are all printed on its front.

What is the Function of the ABA number?

Your bank account and ABA number are all required to make a payment. Customers need not do anything after you've given the payment processor your account numbers. A new ABA number is possible when your Bank is acquired or joins new services, but this routing code is usually automatically transferred. As part of the Federal Reserve Routing System, the first four digits of any ABA number are used to identify a bank's geographic location. However, these numbers aren't always linked to a bank's current location because of mergers and acquisitions.

- The fifth and sixth digits: Transfers made via electronic or wire will go through one of these Federal Reserve banks.

- The seventh digit: The Federal Reserve check processing center for Bank is represented by the 7th digit.

- The "checksum," the sum of the first eight numbers, is the ninth number in any ABA number. The transaction will be diverted if the result does not match the checksum.

What's The Best Way To Track Down Your Aba Number?

Knowing an ABA number means you may wonder what to do without paper checkbooks. Here are some suggestions. Locating an ABA number and the corresponding financial institution can be done in several ways.

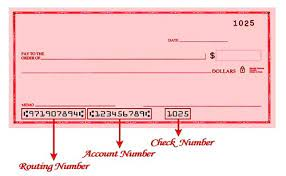

Check If You Have It

Look for the nine-digit code on the left-hand side of your check if it is an individual paper check. Also, the ABA can be found in your checkbook by looking at the bottom of the deposits. If you're looking for the number on an electronic check, you may have to look in a different place.

Check Your Bank Account

A debit card or a credit card account's routing number can be found online if you don't have a paper check or the account's routing number. Direct deposit or ACH information typically contains this ABA number. To open an online banking account, you can contact your Bank or look it up on their website. Some banks have phone numbers for wire transfers, ACH payments, and direct deposits. If you're unsure, contact the Bank's customer service department.

Use Search Tool for ABA Routing Numbers

The American Bankers Association also provides an easy online search tool for ABA Routing Numbers, which is worth noting. The ABA number can be found by entering the name of the Bank and its state or by entering your ABA number.

What's The Difference Between Aba And Wire?

The ABA routing number on your bank statement is what you need for many types of payments requiring a routing number. In the previous paragraph, we mentioned that it's essential to know the Bank's routing code for different payment types. Your check's routing number may differ from the one on the wire. According to the payment type, some banks have a wire routing number specific to that payment.

Conclusion

Every Federal Reserve-recognized financial institution has a unique ABA transit routing number. ABA transit numbers allow employers to deposit checks electronically and have those checks clear more quickly than a paper check. In addition to Fedwire transfers, they are also used. Each of the ABA routing numbers is critical to the transfer process.

Aug 23, 2022 Susan Kelly

Nov 22, 2022 Susan Kelly

Jan 07, 2023 Susan Kelly

Jan 13, 2023 Susan Kelly

Sep 04, 2022 Susan Kelly

Apr 27, 2023 Triston Martin